California will require insurers to reward consumers for wildfire mitigations

(The Center Square) – California homeowners and businesses that take steps to protect their properties from wildfires will soon pay lower insurance rates under a new, first-in-the-nation framework introduced by the state’s insurance commissioner.

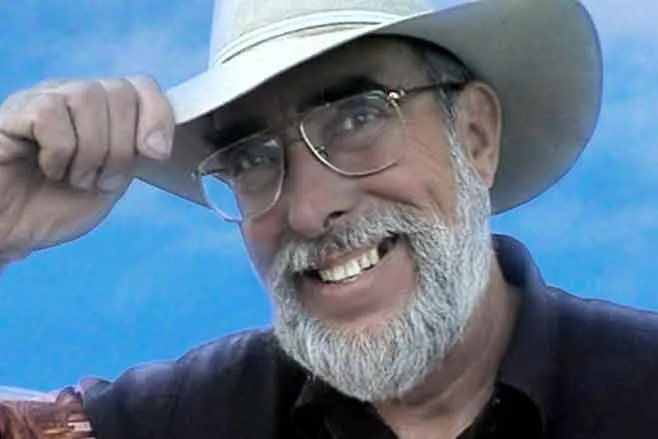

The new regulation, announced by California Insurance Commissioner Ricardo Lara, requires insurance companies to offer insurance discounts to residents and business owners who take wildfire mitigation actions under the state’s "Safer from Wildfires" framework. The framework includes a list of actions that homeowners and businesses can take to reduce the risk of fire, such as upgrading windows and installing a “Class A” fire rated roof.

"Protecting Californians from deadly wildfires means everyone doing their part, including insurance companies by rewarding consumers for being safer from wildfires," Lara said in a statement Monday. "The reality of climate change is driving my determination to help communities better prepare, help our firefighters save lives, and help more Californians find insurance they can afford.”

The new rules come in response to ballooning insurance premium costs for California residents living in fire-prone areas. Insurance costs have skyrocketed in recent years, leaving people between a “hot rock and a hard place in many areas of the state,” Union Policyholders Executive Director Amy Bach told The Center Square.

“Any place that has either burned in the last 10 years or is predicted to burn – people are just getting slammed and it’s very hard to get insurance in these areas,” Bach said.

Bach called the new regulation a “smart compromise between what consumers need and what insurers can live with,” adding that the lack of reward from insurance companies has been an “impediment to getting more people to put the time and money into making their home less likely to burn.”

The regulation comes as Californians are living through more intense wildfire seasons. Thirteen of the top 20 most destructive wildfires in California history have occurred in just the last five years, according to Cal Fire.

Under the new rules, insurance companies are required to submit “new rate fillings incorporating wildfire safety standards” created by the Department of Insurance and establish a process for providing “wildfire risk determinations” to residents and businesses within 180 days, according to a press release from Lara’s office. The regulation also creates a right for residents and businesses to appeal their property’s “wildfire risk score.”

The department said this is an important part of the new regulation because it will increase transparency into how insurers weigh wildfire risk and give customers a chance to appeal if they think the risk has been misjudged.

Supporters of the regulation stressed that the action would incentivize Californians to harden their homes against wildfires and increase the likelihood of homes surviving fires.

“Home hardening retrofits, along with defensible space significantly increase a home’s chance of surviving a wildfire,” said Chief Daniel Berlant, CAL FIRE deputy director of community wildfire preparedness and mitigation. “Using the latest fire science and recent wildfire data, these retrofits and landscaping requirements provide a strong path to structure survivability.”

Members of the insurance industry responded with support for the regulations, but said there is still more to be done.

Seren Taylor, senior legislative advocate of the Personal Insurance Federation of California, said “mitigation discounts must be based on data that aligns the cost savings with the actual risk reduction.”

“We need to allow insurers to use the most advanced technology to more accurately model California’s evolving climate risk, instead of depending on existing rules that require insurers to only look backward at historical data,” Taylor added. “These new tools will improve the accessibility and availability of insurance in high-risk fire zones and better inform homeowners on how to minimize the risk of destruction.”