Montana governor wants tax and housing reforms

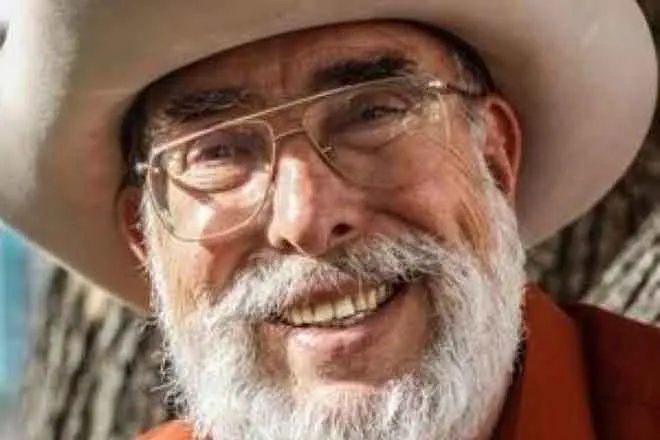

(The Center Square) – Governor Greg Gianforte is calling for “a historic tax package and pro-housing reforms” in Montana.

“Tax relief is a priority,” said the governor at a press conference following a visit to Lewistown. “The demand for more housing has grown for more than a decade, and homebuilding hasn’t kept up.”

The governor’s budget proposes $500 million in property tax rebates for primary residences with a “$1,000 property tax rebate for 2023 and 2024.” It also calls for a reduction in the state’s top income tax rate, while at the same time providing a child tax credit for families with young children. The governor is on record as saying “family is the foundation of our society” and that “we should do everything we can to make families stronger.”

In terms of pro-housing reforms, the governor’s Home Ownership Means Economic Security (HOMES) Program and its $200 million investment to expand housing capacity.

“To sustain our historic economic success, we must increase the supply of affordable, attainable housing,” said the governor at his press conference.

Organizations, including Frontier Institute, have stated that housing is a concern for Montana. This is why Frontier has offered support for bills such as SB 245, which follows the governor’s Housing Task Force Recommendations to reform city zoning regulations.

Gianforte was elected governor in November 2020. Prior to that, he was a business owner turned U.S. Representative from June 2017 to January 2021 when he was sworn in as Montana’s 25th governor.