USDA Update – April 24, 2024

IMPORTANT DATES TO REMEMBER:

- March 15th – July 15 - CRP primary nesting season. No activity is allowed on CRP contracts, except for Grassland contracts. Break-outs of ANY CRP lands is prohibited during PNS. This includes contracts that are voluntarily terminated with refunds made back to CCC and expired CRP contracts.

- July 15, 2025 - Deadline for Spring Certification.

- August 15, 2025 - Deadline to submit E-CAP application.

Disclaimer: Information in this UPDATE is pertinent to Kiowa and Cheyenne County FSA only. Producers reading this and that do not have FSA interest in either county are advised to contact their local FSA Office.

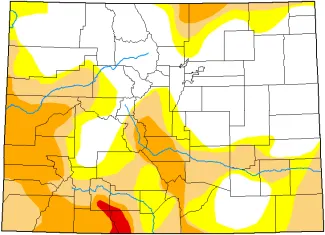

U.S. DROUGHT MONITOR

Heading into the water year and the growing season for native grass, it’s always a good idea to keep up to date with the U.S. Drought Monitor. As the drought monitor is the driving force for several FSA programs. In Kiowa and Cheyenne counties, the growing season for native grass began April 15.

©

The current drought monitor shows no drought intensity in Cheyenne County and only D0 or D1 - abnormally or moderately dry in Kiowa County.

Foreign Investors Must Report U.S. Agricultural Land Holdings

The U.S. Department of Agriculture (USDA) Farm Service Agency (FSA) reminds foreign investors with an interest in agricultural land in the United States that they are required to report their land holdings and transactions to USDA.

The Agricultural Foreign Investment Disclosure Act (AFIDA) requires foreign investors who buy, sell or hold an interest in U.S. agricultural land to report their holdings and transactions to the USDA. Foreign investors must file AFIDA Report Form FSA-153 with the FSA county office in the county where the land is located. Large or complex filings may be handled by AFIDA headquarters staff in Washington, D.C.

According to CFR Title 7 Part 781, any foreign person who holds an interest in U.S. agricultural land is required to report their holdings no later than 90 days after the date of the transaction.

Foreign investors should report holdings of agricultural land totaling 10 acres or more used for farming, ranching or timber production, and leaseholds on agricultural land of 10 or more years. Tracts totaling 10 acres or less in the aggregate, and which produce annual gross receipts of more than $1,000 from the sale of farm, ranch, forestry or timber products, must also be reported. AFIDA reports are also required when there are changes in land use, such as from agricultural to non-agricultural use. Foreign investors must also file a report when there is a change in the status of ownership.

The information from AFIDA reports is used to prepare an annual report to Congress. These annual reports to Congress, as well as more information, are available on the FSA AFIDA webpage.

Assistance in completing the FSA-153 report may be obtained from the local FSA office. For more information regarding AFIDA or FSA programs, contact your local FSA office on the phone or visit farmers.gov.

- subscribe.

- Subscribe to GovDelivery emails: Visit www.fsa.usda.gov/subscribe or contact your local FSA Office.

- For information on programs visit our website located at www.fsa.usda.gov or like us on Facebook or follow us on Twitter. USDA is an equal opportunity employer.

It is the customers responsibility to know what programs and benefits are available.

Highly Erodible Land (HEL) and Wetland Conservation Compliance

Landowners and operators are reminded that in order to receive payments from USDA, compliance with Highly Erodible Land (HEL) and Wetland Conservation (WC) provisions are required. Farmers with HEL determined soils are reminded of tillage, crop residue, and rotation requirements as specified per their conservation plan. Producers are to notify the USDA Farm Service Agency prior to breaking sod, clearing land (tree removal), and of any drainage projects (tiling, ditching, etc.) to ensure compliance. Failure to update certification of compliance, with form AD-1026, triggering applicable HEL and/or wetland determinations, for any of these situations, can result in the loss of FSA farm program payments, FSA farm loans, NRCS program payments, and premium subsidy to Federal Crop Insurance administered by RMA.