Colorado bill would make financial literacy class a graduation requirement

Students at public high schools like East High School in Denver would be required to learn about budgeting, investing and other financial literacy topics if legislation being considered by the Colorado Legislature becomes law. (Quentin Young/Colorado Newsline)

A bipartisan bill in the Colorado Legislature would require public high school students to pass a financial literacy class in order to graduate, an effort sponsors say will help prepare them for a modern world with student loans, credit cards and complex personal budgeting decisions.

“Financial literacy is absolutely critical to anybody’s success. I don’t care if you’re coming out of high school, you’re a business person, you’re just the average guy that’s making a living or you want to run a billion-dollar corporation — it doesn’t matter. If you do not understand financial literacy, you cannot succeed in society,” said Representative Anthony Hartsook, a Parker Republican running the bill.

© iStock - nirat

Hartsook is sponsoring the bill with House Assistant Majority Leader Jennifer Bacon, a Denver Democrat. In the Senate, it is sponsored by Senator Lisa Frizell, a Castle Rock Republican, and Senator Jeff Bridges, a Greenwood Village Democrat.

Hartsook said that when he was a commander in the U.S. Army, he was surprised about how little some soldiers knew about money. He’d get phone calls from creditors or learn that a soldier’s check bounced, and he’d then order them to take a financial literacy class.

“Their whole world was opened up,” he said.

A recent Bankrate poll found that one-third of Americans have more credit card debt than emergency savings as the country grapples with the effects of the COVID-19 pandemic, inflation, the rising cost of living and stagnant wages. It also found that about one-quarter of Americans have no emergency savings at all. People aged 18 to 28 were the most likely to report that they had no emergency savings or credit card debt.

“I would like to see, not only statewide, but eventually moving nationwide, a generation coming up that understands finances, spends within their means, understands how compound interest works — and they don’t get in over their head and then declare bankruptcy or have to get a loan consolidation or something like that,” Hartsook said.

Colorado law encourages school districts to require financial literacy coursework for graduation, and about one-quarter of districts do so,according to the Colorado Department of Education.

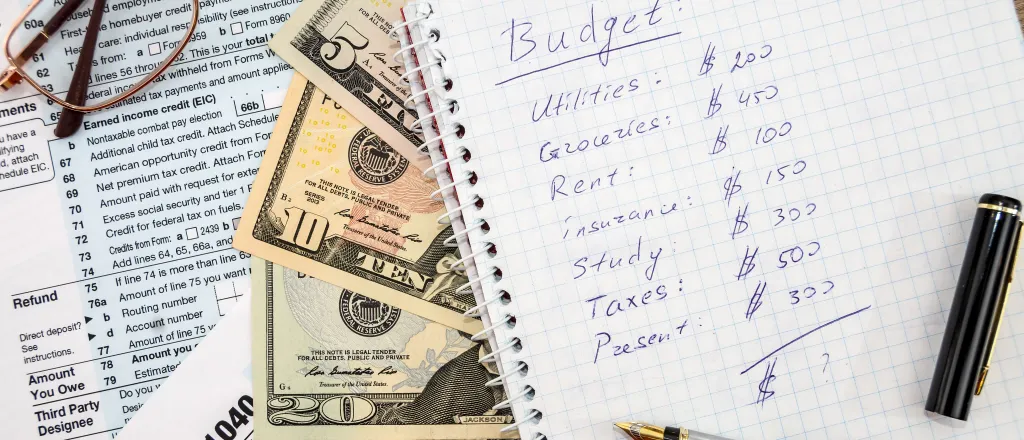

© iStock - Mamphotography

House Bill 25-1192 would switch that from a recommendation to a requirement, and public high school students would need to complete a financial literacy class in their junior or senior year. The class would need to cover the standards adopted by the State Board of Education in 2022, which include topics like household budgeting, saving, investing, using credit, and understanding the difference between leasing and buying large purchases like cars and homes.

CDE has a resource bank of financial literacy educational webinars, online programs and other curricula, including some free options. That includes free courses from Next Gen Personal Finance, which is associated with a nonprofit registered in support of the bill.

The organization’s goal is to require all high schoolers nationwide to take a financial literacy course by 2030. It is tracking financial education bills in 14 states and directly supporting bills in Colorado, New Jersey, North Dakota and Texas.

Ten states require high school students to pass a financial literacy course to graduate, and 16 others have passed legislation and are in the process of implementation.

The bill would also make completion of the federal or state financial aid form, known as a CASFA or FAFSA, a condition for graduation. Students and parents would be able to opt out of that requirement. Twelve states have universal FAFSA laws, according to the National College Attainment Network.

Groups including the Colorado School Counselor Association are opposed to the bill because of that FAFSA requirement, arguing that it would increase caseload on a workforce already stretched thin.

“Some schools have folks within their buildings that are specifically trained for this, but the burden would still fall on those high school educators, and we’re just not trained on it consistently,” said Vicki Helfer, an Aurora Public Schools counselor and CSCA board member.

She said that even though there is an opt-out provision, the language is confusing.

“There are plenty of counselors across the state who share stories with us about students dropping out of school when faced with confusing graduation mandates, even though they have these opt-outs,” Helfer said.

She said CSCA would support the bill if the provision was removed.

In his budget request, Governor Jared Polis asked for $300,000 to increase financial literacy and FAFSA completion in schools. Colorado students missed out on $55 million in federal aid by not completing the forms, he wrote in his November budget letter to lawmakers.

The bill is scheduled for its first committee hearing with the House Education Committee February 27.