Credit unions in conversation after banks' collapse

© Pogonici - iStock

(Colorado News Connection) The collapse of two banks has put the U.S. financial sector into focus this week.

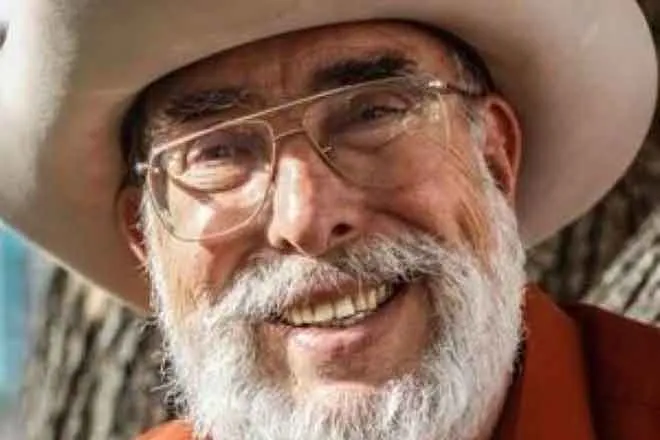

Some are considering the alternative structures of institutions like credit unions. Troy Stang is the president and CEO of the GoWest Credit Union Association, which represents more than 300 credit unions in Colorado and five other states.

He said tumult in the financial market historically generates interest in the local structure of credit unions.

"Whether it was with the dot-com bust, whether it was with the activities that led up to the Great Recession," said Stang, "consumers at their kitchen tables started having these conversations more intentionally about who is it that we do our financial services with?"

Silicon Valley Bank's collapse is the second largest bank collapse in U.S. history. To get depositors their money, the Federal Deposit Insurance Corporation has stepped in.

Stang noted that the National Share Insurance Fund administered by the National Credit Union Administration is the equivalent regulator for his institutions and is paid for by the credit union system.

Stang said credit union are not-for-profit and member owned.

"We're not accountable to Wall Street investors," said Stang. "We're not accountable to other forces outside of our membership. And so it's a much different model."

Stang said many of the credit unions in his association have spent the last week reassuring customers and noting differences in their institutions' structure from others.

He added that a strong financial system is important for consumers, regardless of which institution they bank with.