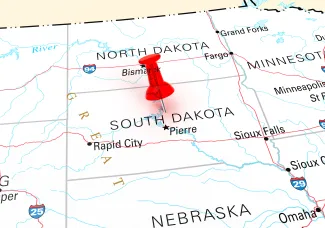

Opponents: Ballot measure would have 'drastic' impacts on South Dakota schools

Click play to listen to this article.

(Greater Dakota News Service) A coalition of South Dakota groups is voicing its opposition to a ballot measure intended to end a state sales tax on consumables.

If passed this November, Initiated Measure 28 would repeal the state's 4.2 percent sales tax on "anything sold for human consumption," including food and other products from toothpaste to tobacco, CBD and vaping products.

Sandra Waltman, director of public affairs for the South Dakota Education Association, said the teachers union opposes the repeal because it does not include a plan to replace the money the current tax contributes to education.

"Our main reason for opposing this is the lack of a plan for replacing the $176 million and what that will do, not only for K-12 students but for higher education," Waltman explained. "Districts would probably be looking at a very bare-bones budget."

Currently, Waltman said about 60 percent of public school funding comes from state coffers, and the other 40 percent from local property taxes. She called the potential effect on education "drastic," saying they could lead to fewer teachers, larger class sizes and cuts to newer resources like mental health support and programs for career and technical education.

Proponents of the measure said repealing the tax could help the nearly 9 percent of South Dakotans who are food insecure but Waltman countered the same people would likely feel the effects of underfunded school systems.

"To repeal one tax without a more broad conversation about how you replace that revenue is shortsighted, and we think you shouldn't just be repealing a tax without a plan."

Other groups opposing the measure include the South Dakota Cattlemen's Association, Chamber of Commerce and Industry, South Dakotans Against a State Income Tax and the South Dakota Farm Bureau.