What are smart ways to prepare for retirement?

Planning for retirement requires taking small steps that make a big difference. As you explore these smart ways to prepare for retirement, you’ll understand what you need to do. Ultimately, it’s all about following strategies to help you live a comfortable life after leaving the workforce.

Pay off debts

Entering retirement debt-free is ideal for retirees. When you don’t owe anyone money, you can spend your funds how you like. Pay off debts before retiring to prevent payments from derailing your savings. Pay off high-interest debt while working, and consider consolidating other debts. The ultimate goal is to pay off as much as you can before retiring!

Know your employer’s pension plan

A pension plan is an employee benefit plan maintained by an employer that provides retirement income to employees. If your job has a traditional pension plan, ensure you are on it and understand how it works. You can also ask for a benefit statement to see the worth of your benefits.

Track your spending

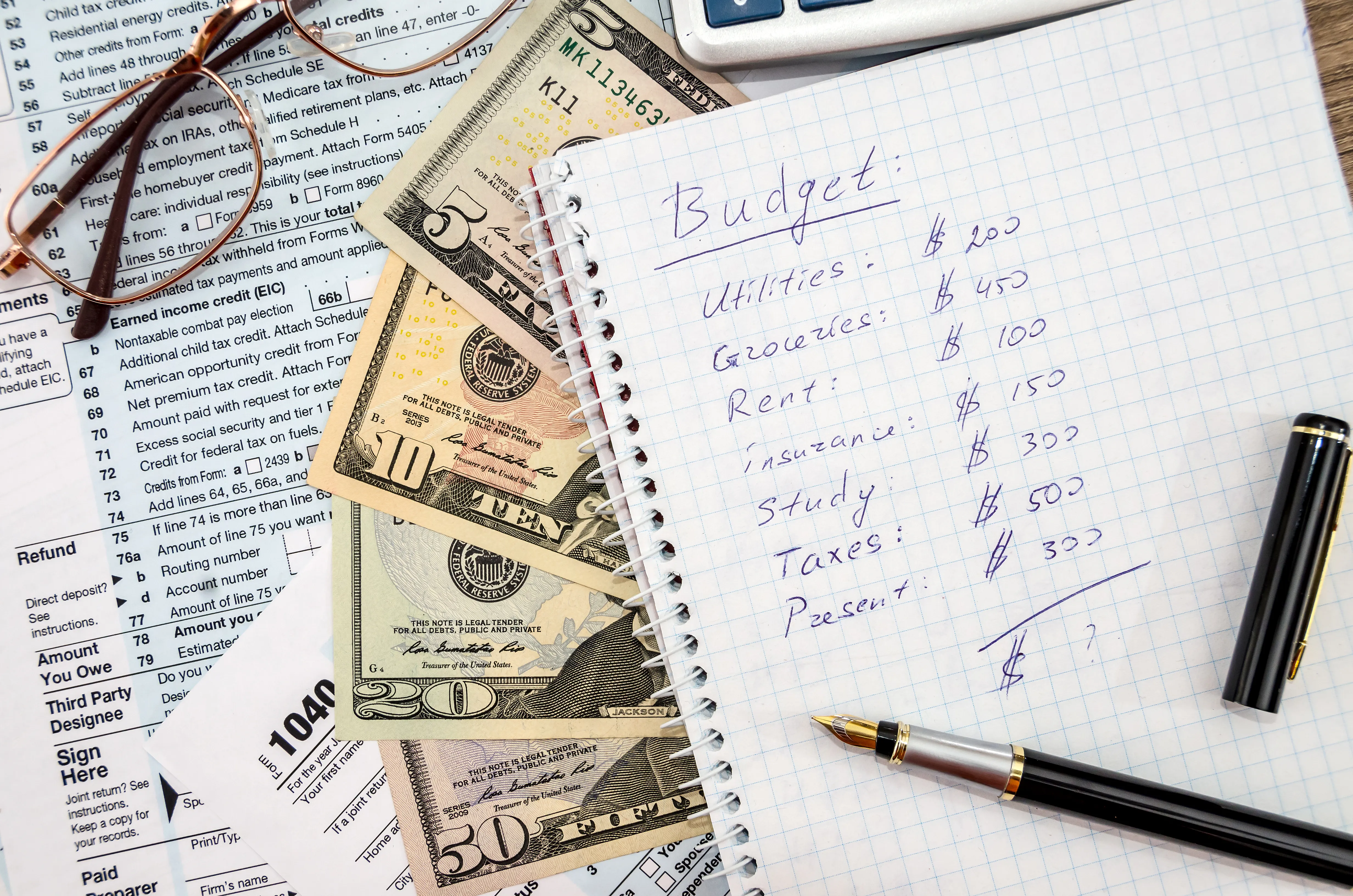

Tracking your spending is another smart way to prepare for retirement. Knowing where your money goes can give you a better understanding of your lifestyle. Keep a record of monthly expenses and sources of income. Look for areas where you can save money, and create a mock retirement budget before leaving the workforce. This way, you can live a comfortable life without spending too much of your savings and pension plan too quickly.

Consider downsizing your home

You might want a simple lifestyle going into retirement. However, things can prevent simplicity. In particular, your home can overwhelm you. One sign it’s a good time to sell your home is that it’s too much to maintain. Many retirees downsize their homes to limit their chores and responsibilities. Downsizing also decreases the amount of money they pay for utilities. If you’re an empty nester or interested in lowering your bills, selling your home may be a good idea! After all, smaller properties are easier to maintain.

Envision a retirement lifestyle

Envision your next stage of life and what goals you want to achieve. Maybe you have plans to travel, start a new hobby, or move to a different city or state. Keep in mind that your lifestyle will radically influence your financial needs. Create an overview of your new lifestyle, and track potential expenditures. You’ll want to start retirement with funds to support all of your initiatives. Consider seeking a financial advisor to review your retirement lifestyle and ensure you can afford it.