Commentary - Climate group exodus is good for pensioners and taxpayers

The nation’s big investment firms and banks have withdrawn from net-zero climate groups amid questions from Nebraska and many other red states about whether they’ve put consideration of environmental, social, and governance (ESG) issues ahead of financial returns in investment decisions.

As a former state treasurer of Nebraska, I know that the fiduciary duty of those who manage our public pensions cannot and should never be usurped by other interests. Asset managers and big banks know that as well, but for many years have been getting away with being part of climate agreements and net zero pacts. Not anymore.

BlackRock recently left the Net Zero Asset Managers (NZAM) initiative, and six banks — JP Morgan, Citigroup, Bank of America, Morgan Stanley, Wells Fargo and Goldman Sachs — withdrew from the United Nations-sponsored Net Zero Banking Alliance (NZBA).

This mass exodus is good news for taxpayers and pensioners alike, and it’s thanks to leaders who have made ESG a priority the past few years. It is the job of public officials to police issues like this one, and I applaud them for doing so.

On top of that, BlackRock recently agreed to concessions in a lawsuit filed by the Tennessee attorney general accusing them of violating consumer protection laws in their prioritization of ESG. This proves that financial institutions got the message.

It’s time to turn the page and end the era of weaponization of pensions. With ESG on the ropes, state financial officers are on a clear path to do what’s best and focus on returns.

Public funds should always be invested with fiduciary considerations and duties top of mind — and nothing else. The decisions of a pension asset manager should be based on financial concerns such as the safety of funds, returns on investment, and the like — not on personal whims or political interests.

If fiduciaries are prioritizing non-financial concerns, they are not doing the work they were enlisted to do. Fiduciary obligation should be the guiding principle of asset managers and consultants, administrators of public finance and borrowing, and government agency finance experts. Their work, when it comes to finance, must remain free of outside influences.

It’s a mistake to require the state to avoid consideration of any factor that might affect investment, especially for reasons that don’t involve finance.

The determination of whether to invest in a particular industry at a particular time is a financial one. That’s why we hire professionals. And it’s why we shouldn’t restrain them with political legislative mandates.

With ESG gone, we defeated a distraction. Our public finances are better off because of it, and we should congratulate the state financial officers who took on the most powerful financial institutions and won. David beat Goliath.

Now is the time to move on and get back to work.

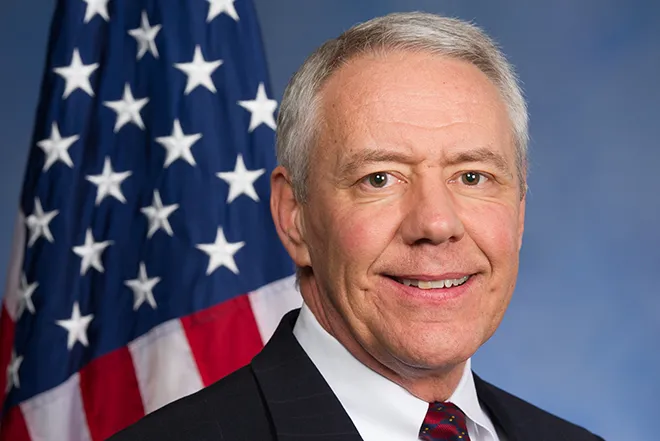

John Murante is a former Nebraska state treasurer, former state senator and former executive director of the Nebraska Public Employees Retirement Systems.