How Your IRA or 401(k) can Become a Tax-Free Gift for Your Loved Ones

The IRS is coming – eventually – for the money in your 401(K) or Traditional IRA.

As a result, people who think they have $500,000 or $1 million stashed away for retirement will learn they have less than they realized once they start withdrawing the money and have to pay taxes on those withdrawals.

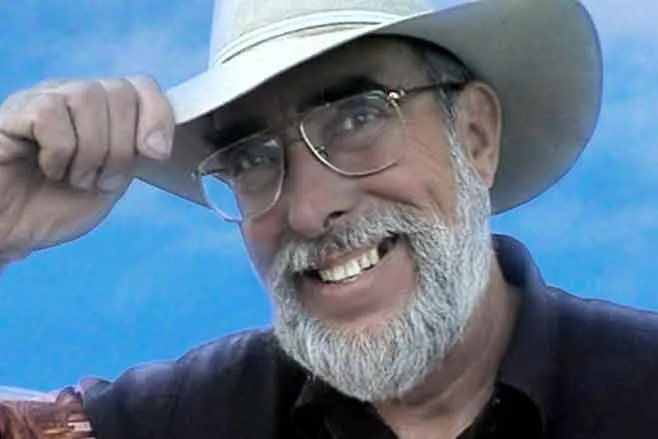

“It’s not enough to simply save money and grow an IRA and 401(K),” says Troy Bender, president and CEO of Asset Retention Services Inc.

“If those accounts are heavily invested in the stock market, you may wake up one morning to see your retirement fund shrink drastically.”

What’s worse, Bender says, is that once a person turns 70½, what’s called the Required Minimum Distribution kicks in. This means each year you must withdraw a certain percentage from those tax-deferred accounts – whether you want to or not. And the worst part is the percentage grows larger as you age.

“I work with a lot of clients who don’t need IRA/401(K) distributions because they’re doing fine on their Social Security, a pension and perhaps other savings,” he says. “They would just as soon leave the money where it is, but the IRS says they have to withdraw the money and pay the taxes – or face a hefty 50 percent penalty of the required minimum amount each year.”

But there are options, especially if you can live without that money. If your goal is to leave a legacy to loved ones, there is a great option. Bender’s option is to use a life insurance policy to turn that retirement savings into an income Tax-Free gift for your spouse, your children or your grandkids.

Here’s how that works:

This is the part where it’s key that you don’t need all the required minimum distributions for your daily living. If you need the income from your RMDs to pay for bills, household expenses, etc., it’s important to take care of those items before looking into purchasing life insurance for the purpose of leaving a legacy.

You can take the RMDs from your IRA, pay income tax on the distributions, and use the balance to pay the premiums on a life insurance policy. This is very popular because you must take the RMDs each year. The reason this is popular is because you can choose to use some of your money, or all of it, to fund a life insurance policy depending on what your needs are. Anytime you can turn a 100% taxable investment into 100% Tax-Free, that’s a good thing, because it has the ability to increase your net worth through the leverage of life insurance and the Tax-Free component.

If you own an annuity and you can withdraw monthly income which will satisfy your required minimum distribution, this is an option that others choose to use as well.

The Tax-Free part. If you leave an IRA or a 401(K) to anyone other than your spouse, they’re required to start taking distributions the next year regardless of their age. And of course, they pay taxes on those withdrawals, Bender says. That’s not true with life insurance. The beneficiary named in a life insurance policy doesn’t owe any taxes on the amount they receive and thus, it is a true gift.

“As a reminder, this isn’t an option for anyone who needs that retirement savings just to survive,” Bender says. “But others, if they want, can set things up so 20 years from now, when they pass away, their spouse can have a nice Tax-Free gift to use for paying off a mortgage, replacing reduced Social Security benefits or a lost pension. If the benefit were to go to a child or grandchild the Tax-Free proceeds could be used for college, grad school or to make a down payment on a house.” In every scenario, it will certainly bring a smile to the beneficiary