New law exempts Oklahoma livestock from personal property taxes

(The Center Square) - A new law would make all livestock that supports families exempt from personal property taxes in Oklahoma.

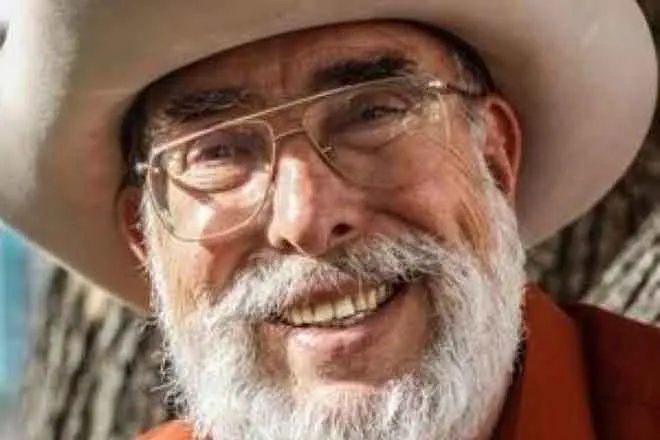

"According to the Oklahoma Constitution Article 10, animals with value less than $100 are exempt from personal property tax," said Rep. Dustin Roberts, R-Durant, in an email to The Center Square. "HB 1682 extends this exemption to all livestock no matter their value."

The list of livestock exempt includes horses, cattle, mules, asses, sheep, swine, goats and poultry, according to a news release.

The law includes livestock owned by "a general or limited partnership, a corporation, a limited liability company, an estate, a trust, or other lawfully recognized entity, as well as those owned wholly or in part by a resident or corporation of a state other than Oklahoma."

"This bill will save Oklahoma ranchers and families that raise livestock quite a bit in taxes," Roberts said. "It's part of a broader effort to make sure Oklahoma taxpayers get to keep more of their hard-earned income, which in turn boosts our overall economy."

The bill would not have an effect on state revenue since the state "does not collect any ad valorem taxes," Roberts said.

Oklahoma lawmakers passed House Bill 2805 last year that exempted livestock used to support families from ad valorem taxes.

Cattle is big business in Oklahoma. The 2017 USDA Ag Census, the last one taken, shows the market value of Oklahoma livestock was $5.95 billion, according to Roberts.

"Cattle represented $3.73 billion of that total," Roberts said. "Swine is the next largest of all livestock at $1.03 billion."

The bill passed both chambers unanimously and was signed by Gov. Kevin Stitt last week. It goes into effect on Jan. 1, 2023.