Over 54 percent of Colorado’s tax revenue from personal income taxes

(The Center Square) – More than 54 percent of Colorado’s tax revenue came from personal income taxes in fiscal year 2021, according to a recent study from Pew Charitable Trusts.

That's a more than 4 percent increase when compared to the previous year, the report said. The rest of the state's revenue comes from general sales taxes (19.5 percent), selective sales (15.5 percent), and corporate income taxes (6.8 percent).

Colorado's percentage of total tax revenue coming from personal income taxes is also the fourth highest in the country behind Oregon (63.2 percent), California (59 percent), and New York (58.8 percent).

Nationally, personal income taxes make up an increasing share of states' revenue streams, accounting for 39.9 percent of taxes collected in 2021 compared to 36.5 percent in 2020.

“Taxes make up about half of state government revenue, with two-thirds of states’ total tax dollars coming from levies on personal income and general sales of goods and services,” the study said.

During the 2022 legislative session, state lawmakers passed legislation to reduce property taxes and delay a fee increase on gasoline. Colorado taxpayers are also set to receive a $750 tax refund required under the Taxpayer's Bill of Rights.

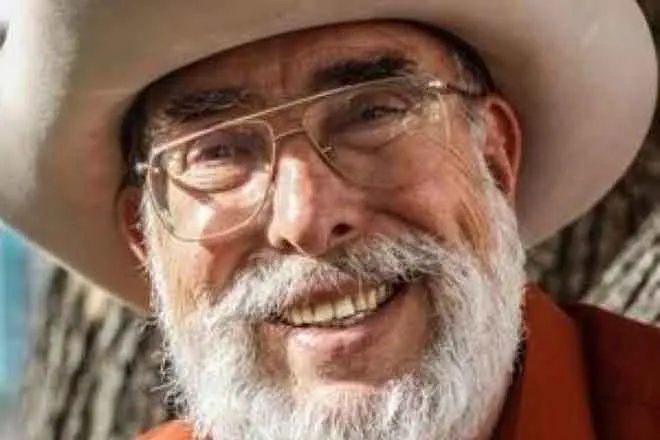

Governor Jared Polis has said the state's income tax “should be zero.”